You can set up occupational pensions within the QTAC software.

Once the pension is activated, the software will take regular contributions from the employees each pay-period. If you require information about Auto Enrolment pensions see: Auto Enrolment: Workplace Pensions

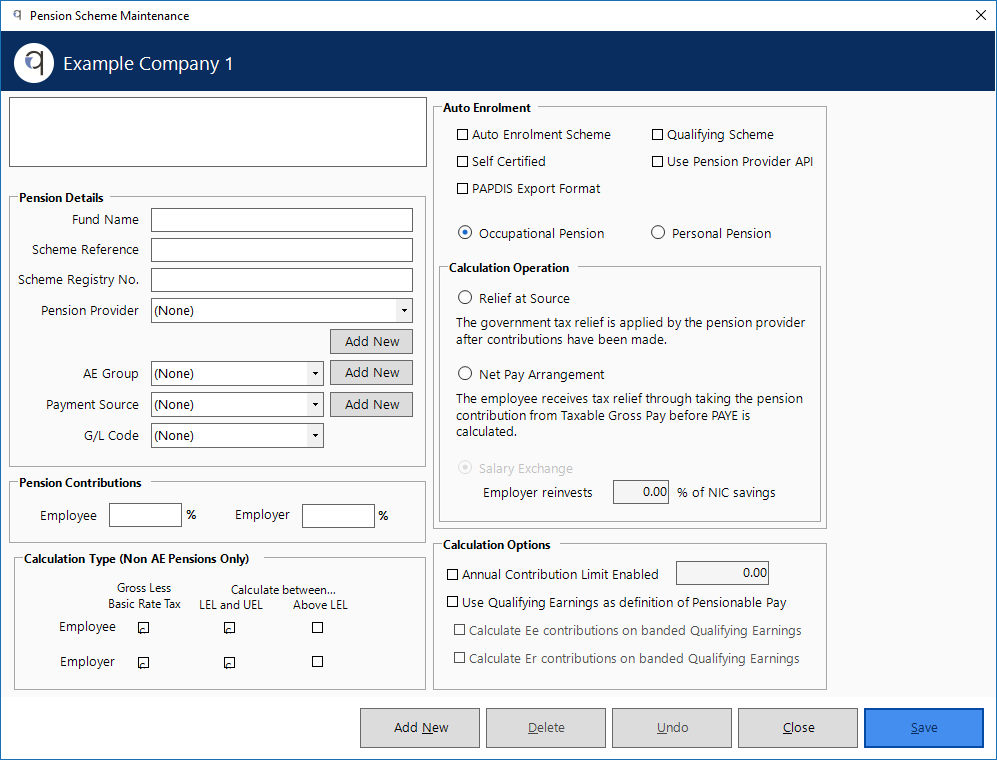

Pension Maintenance

Firstly you will need to create the pension in the “Pension Scheme Maintenance”. This can be accessed by selecting “Company > Pensions” from the menu at along the top of the software.

- Give the pension fund a name in the “Fund Name” box.

- Most of the fields you see “Scheme Reference”, “Pension Provider”, “AE Group” and “Payment Source” are all for an Auto Enrolment Pension. You do not need to fill these in for an occupational pension.

- “GL Codes” are for external reporting software. If you are using “General ledger” codes in another piece of software you can assign a code to the pension deduction. These are not essential, so if you are not using GL codes – or do not know what they are – then you don’t need to fill out this information.

- Select your pension contribution amounts for the employee and the employer.

- On the right hand side of the pension maintenance there are 2 main boxes. The top box is for Auto Enrolment pensions. For setting up an occupational pension we only need to look at the second box labelled “Calculation Type”. These options allow you to select the different option for how the contributions are calculated.

- If you want to have the contributions taken between the LEL and UEL you can choose these options for the employee and/or employer.

- If you want the software to calculate after tax deductions you can tick the boxes for “Gross less basic rate tax”.

Employee Maintenance Settings

You are also able to modify each employees pension details. You can access this information by selecting “Employee Maintenance” from the“Employee” menu along the top of the software.

- Within an employees pension maintenance you will have to select the pension that you want them to be on from the drop-down box.

- Drop down the “Scheme Type” menu box and select the appropriate scheme type for your pension. The scheme type that you chose is determined by your arrangements with the pension provider. Its worth noting that “Contracted Out Pensions” are being abolished as of the 16/17 tax year.

- Select the contributions that the employee and employer will contribute. These details will be pulled from the pension maintenance by default but they can be adjusted here for the individual employee.

- If the pension has come to an end then you will have to add in a pension end date in the required field.

- you can also add in an additional pension fund if the employee is paying into a second pension. The details needed will be similar to the ones you have entered for the initial scheme.

Once you have created the Pension in “Pension Maintenance” and in “Employee Maintenance” you will see the contributions being deducted from an employees pay in the next period.

Pension In Open and Pay

Once you have entered the open and pay screen for the employee you can view the pension details that you have set for the employee by clicking “Change” and then on the “Occupational Pension” tab.

Here you can:

- View the main pension fund if you have one setup in the employees “Employee Maintenance” screen.

- Adjust the percentages or values for the employees contributions within the pay period.

- Add in an additional pension fund and choose its contribution values for the period.

- Click the “Save Pension” button once you are happy with the changes.

Its worth noting that any changes that are made in this window will only affect the pension for this particular period. If you wish to make a permanent change you should amend the pension in “Company > Occ Pension” or in “Employee Maintenance > Occ Pension”.

A little bit about us...

Qtac, a recognised payroll solutions provider in the UK, has been serving businesses for 30 years. Specializing in both payroll software and outsourced payroll services, Qtac caters to small businesses, large corporations, and payroll bureaux. Our software, recognised by HMRC, streamlines the payroll process, featuring RTI submissions, workplace pensions management, and a cloud-based portal for payslips and employee self-service. This software is supported by top-tier customer assistance, ensuring a smooth payroll experience.

Additionally, Qtac offers tailored ‘white-labelled’ outsourcing services. These services are particularly attractive to accountancy firms, as they save time, reduce stress, and mitigate payroll-related risks. By outsourcing to Qtac, companies can be confident in the knowledge that their payroll needs are being expertly managed.

Qtac's solutions are not just about functionality; they are about building long-lasting relationships with clients, offering them a combination of technology and expertise. Their commitment to adapting to client needs and providing reliable, efficient services has established Qtac as a trusted name in the payroll solutions sector in the UK. In essence, Qtac simplifies and enhances the payroll process for a diverse range of clients, ensuring compliance, efficiency, and customer satisfaction.

Need some help?

Contact SupportOur team are here to help... |